Get clear answers to frequently asked questions about proprietorship setup, benefits, legal formalities, and compliance—so you can start your business in India with clarity and confidence.

Get your Icegate Registration at just 1,999/-*

*Govt. fees and GST on actuals

You Get -

- Expert Assistance from CA / CS

- Icegate Registration

- No Hidden Charges and Full Transparency

- Total Process takes 3-5 days

ICEGATE Registration

The Indian Customs Electronic Gateway, or ICEGATE, is a vital gateway for the trade community. It provides a simplified platform for filing customs paperwork electronically, including Bills of Entry and Shipping Bills. In order to expedite customs clearance and improve transparency in global transactions, this registration is more than just a formality. Given how important this procedure is, India Company Setup provides businesses with specialised support to make sure their ICEGATE registration process runs smoothly.

Entities engaged in international trade—including cargo carriers and commercial partners—need ICEGATE registration. Through the Indian Customs Electronic Gateway, it helps them to electronically file necessary customs documentation including Shipping Bills and Bills of Entry. By decreasing paperwork and improving electronic submissions, this digital platform is meant to simplify and speed up the customs clearing process, hence improving processing times, operating costs, and visibility of shipment statuses.

Make the initial move toward a smooth customs clearing process by getting in touch with our professionals right now!

What is ICEGATE?

As previously stated, ICEGATE, or Indian Customs Electronic Gateway, is a significant attempt by Indian Customs to digitalize and accelerate the customs clearance procedure. Through the official ICEGATE login, it acts as the digital gateway for communication between the customs service and the commerce and logistics community. It makes it easier to electronically file customs paperwork, including Bills of Entry for imports and Shipping Bills for exports.

Qualifications for ICEGATE Enrollment

A broad spectrum of organizations participating in the import and export process are eligible to register with ICEGATE. Through the official ICEGATE login, eligible entities can register and access this digital site. The entities that qualify for the ICEGATE registration process are listed below:

1. F card Custom Brokers or Custom House Agents (CHA -Individuals, Firms or Employees

2. IEC Certificate Holders

3. Console agents

4. Shipping Agents

5. Airlines

6. Air Cargo Agents

7. IEC Authorized persons

How Come Traders Must Register for ICEGATE?

ICEGATE registration is mostly necessary to electronically file important paperwork associated with customs clearance. The following papers cannot be submitted online using ICEGATE Login without a registered ICEGATE ID:

Shipping bills: which list the contents, value, and destination of the shipment, are necessary for the export of products from India.

A bill of entries: which details the arriving items, their value, and the associated charges, is required when importing commodities into India.

Benefits of ICEGATE Enrollment

For companies and individuals involved in international trade through India, registering with ICEGATE offers several significant advantages that streamline and improve the customs clearance procedure. Among these benefits are:

1. Users with an ICEGATE ID may send all necessary customs documentation online—including shipping invoices and bills of entries—using a single, centralized portal. This speeds the submission process and eliminates the necessity for paper records.

2. Through ICEGATE’s online document monitoring system, registrants can keep an eye on the state of their filings, therefore offering openness and current information on the development of their customs employment.

3. Users get quick acknowledgements about the submission status of their papers right at their registered email. Essential for tracking and reference, this covers both positive and negative acknowledgements as well as unusual numbers for Bill of Entry (BE) and Shipping Bill (SB).

4. Effective Communication: ICEGATE helps traders and the customs department to have flawless correspondence. Although any email ID can be used for incoming files, important outgoing correspondence including inquiries and responses are only directed to the registered email in the ICEGATE database, therefore guaranteeing safe and dependability.

5. These benefits collectively contribute to a more efficient, transparent, and manageable customs clearance process, making ICEGATE an indispensable tool for those involved in India’s international trade.

Various Transaction Styles qualified for the ICEGATE Registration Program

You can register for a broad range of transaction types at ICEGATE, therefore meeting the various needs of the global trading community. The main transaction forms for which you may register at ICEGATE are broken out here:

Primary Transaction Types

1. Exports: Registration for exports allows you to file Shipping Bills electronically, facilitating the smooth export of goods from India.

2. Imports: Import registration enables the electronic submission of Bill of Entries, which is essential for clearing imported goods into India.

3. IGM (Import General Manifest): IGM registration is crucial for shipping lines, airlines, and cargo agents to declare the details of cargo arriving in India.

4. EGM (Export General Manifest): EGM is necessary for exporters and shipping agents to file details of cargo being shipped out of India, ensuring compliance with export regulations.

5. Consol Manifest: This registration is vital for consolidators to file consolidated cargo details, enhancing cargo handling and customs clearance efficiency.

Additional Transaction Capabilities

Beyond these main exchanges, ICEGATE also serves several other particular purposes to enable more seamless trade operations:

1. Query Replies: ICEGATE allows for the submission and management of queries related to customs processing, enabling efficient resolution of issues.

2. Amendments to BE (Bill of Entry) and SB (Shipping Bill): The platform offers the flexibility to make necessary amendments to these documents, ensuring that all information is accurate and up-to-date.

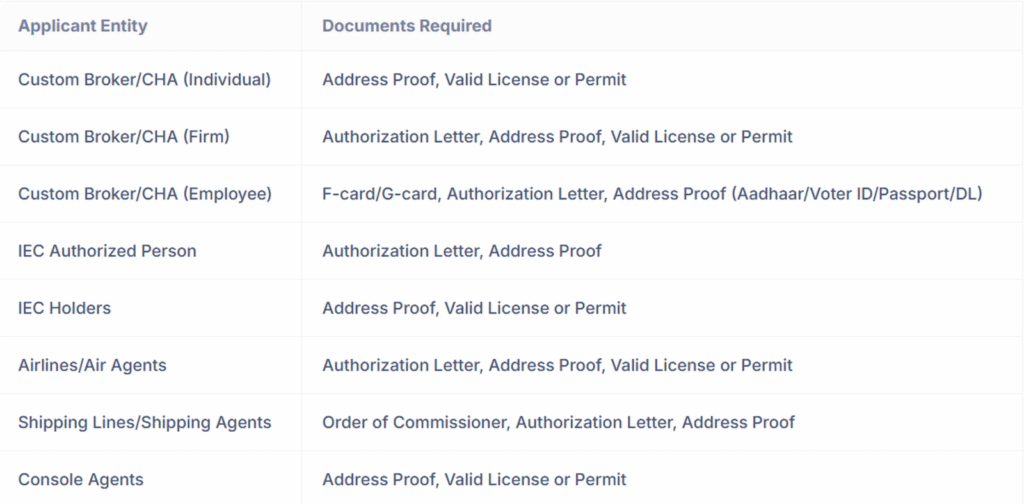

Documents Needed for ICEGATE Registration

Here is the list of files needed for ICEGATE registration; start using the digital portal with official ICEGATE Login:

Note: For ICEGATE registration, the following are considered valid address proofs for the applicant:

1. Aadhaar Card

2. Voter ID

3. Driving License

4. Passport

Forms of ICEGATE Registration

To meet the varied needs of the trading community, ICEGATE provides several registration forms. Knowing these kinds helps organizations decide which registration route best fit for their activities. The several kinds of ICEGATE registrations are summarized here:

ICEGATE Partnership Registration

This kind of registration is meant for partners who want to file electronic documents using the ICEGATE system. It fits companies seeking a complete digital interaction with customs for import/export operations.

ICEGATE Simplified Registration

The Simplified Auto Registration is meant to make importers and exporters’ registration process more easily available. It offers them necessary information services and the capacity to submit some kinds of documentation without the whole powers of full partnership registration.

Primarily based on the Importer Exporter Code (IEC) and Goods and Services Tax Identification Number (GSTIN).

Requires OTP verification for email and mobile phones to ensure security.

Allows for a more straightforward registration process without uploading a ICEGATE Digital Signature Certificate (DSC), verifying PAN, uploading additional documents to ICEGATE, or undergoing a detailed approval process.

Important Note:

Entities registered under the Simplified Auto Registration category have restricted capabilities and are not qualified to send customs documentation through ICEGATE. For organizations needing simple portal access for information and minor filings excluding thorough customs documentation, this registration form is perfect.

ICE GATE Registration: Relevant Customs Ports

With just one registration across all Electronic Data Interchange (EDI) enabled Customs Ports in India, ICEGATE’s extensive registration system helps users to complete transactions.

DGFT Guidelines for ICEGATE Registration System

Particularly those planning to file papers utilizing the Remote EDI System (RES), the Directorate General of Foreign Trade (DGFT) offers thorough guidance for organizations wishing to register on ICEGATE. DGFT’s main ICEGATE registration rules are briefly summarized here together with instructions on building an ICEGATE Digital signature:

Instant Registration for IEC Holders:

IEC holders intending to submit documentation on ICEGATE are advised to register immediately using the new Registration Module in order to ease their document filing procedures.

DSC, ICEGATE Digital Signature Certificate, Requirement:

Before beginning the registering process, users are advised to have their Class III Individual Type DSC tokens ready and connected into their systems.

DSCs must be uploaded under registration to guarantee safe transactions and validate the user’s identity.

PAN Verification

During registration, the applicant’s PAN will be cross-verified against the Income Tax Department’s PAN database to guarantee validity and correctness.

Additionally submitted should be a scanned PAN card copy, thereby verifying the applicant’s information.

1. Name Consistency

The name provided during the ICEGATE registration should match the name on the applicant’s PAN card to avoid discrepancies and potential issues in the verification process.

2. CHA Employee Registration

Custom House Agent (CHA) registrants only G-Card holders are eligible. This is so because G-Card holders have DSC, a capacity not granted to H-Card holders, which lets them digitally sign papers.

3. Registration of Parent and Child Users

An entity can register one parent user on ICEGATE, then register additional users as child users under the main account, therefore enabling controlled access and management.

4. ICES Registration Number Utilization

The ICES (Indian Customs EDI System) registration number provided during the registration process is used to access information from ICES directories and is displayed for verification purposes.

5. Data Collection and Verification

The data collection process for the registration commences once the applicant verifies the information provided, ensuring that all entered data is accurate and confirmed by the user.

6. Authority to Disable IEC-Authorized Person

Suppose an IEC-authorized person is no longer associated with the IEC holder. In that case, the IEC holder has the right to disable this person’s access in the ICEGATE Registration module, ensuring security and control over who has access to file documents on behalf of the entity.

Simplify Your ICEGATE Registration Using India Company Setup

Selecting India Company Setup to enable flawless ICEGATE registration and ICEGATE login setup It guarantees that your company follows all customs rules exactly and without any complexity. From beginning to conclusion, we offer professional assistance including building an ICEGATE digital signature. India Company Setup offers tailored advice at every stage of the registration procedure using a team of committed professionals well-versed in the nuances of international trade rules and the ICEGATE platform.

What We Offer

At India Company Setup, we deliver a complete suite of business services to help you start, grow, and manage your company with ease. From registration to regulatory compliance, our expert support ensures your business stays legally sound and financially organized.

Daily & Monthly Bookkeeping

- Record all financial transactions.

- Maintain audit-ready books in sync with GST and Income Tax laws

- Stay prepared for MCA and statutory filings

Financial Reporting

- Preparation of Profit & Loss Statements and Balance Sheets

- GST and MCA-compliant financial reports

- Cash flow reports for better financial planning

Reconciliation Services

- Reconcile bank, GST, and TDS records

- Identify and resolve mismatches proactively

- Maintain accuracy for timely Income Tax and MCA submissions

Secure Digital Bookkeeping

- Encrypted cloud-based accounting systems

- Anytime, anywhere access to your business data

- Aligned with India's data protection and compliance standards

Benefits of Our Bookkeeping Services

1. Accurate Financial Records

Our expert bookkeeping ensures every transaction is correctly recorded, reducing compliance errors and giving you a clear picture of your company’s financial health — crucial for GST, Income Tax, and MCA filings.

2. Time-Saving

Focus on growing your business while we manage your books. By outsourcing to us, you eliminate the burden of paperwork, reconciliations, and regulatory upkeep — saving you both time and effort.

3. Better Cash Flow Management

We help you monitor income and expenses in real time, so you maintain a healthy cash position, make informed decisions, and avoid last-minute cash crunches or missed tax deadlines.

ICEGATE (Indian Customs Electronic Gateway) is the official portal of the Central Board of Indirect Taxes and Customs (CBIC) that facilitates electronic filing of documents like Bill of Entry, Shipping Bills, and Customs declarations. Registration is essential for importers, exporters, and customs brokers to access e-filing, tracking, and various customs-related services.

Entities that need to interact with Indian Customs—such as importers, exporters, Custom House Agents (CHAs), freight forwarders, and logistics providers—must register on ICEGATE to file documents and track shipments.

You will need:

Import Export Code (IEC)

GST Identification Number (GSTIN)

PAN of the business

Email ID and mobile number linked with IEC

Digital Signature Certificate (DSC) for authentication

After registering, users can access services such as:

E-filing of customs documents (Bill of Entry, Shipping Bill, etc.)

Real-time shipment tracking

Customs duty payment

Online status of refund claims, drawback processing, and more

ICEGATE registration is usually approved within 1 to 3 working days, provided all documents and details are correct. In case of discrepancies, it may take longer.

FAQ

Get Answers to Common Financial Queries

Call Us

9915731447

Mail Us

info@indiacompanysetup.com

Why Choose Us ?

At India Company Setup, we simplify the process of starting your proprietorship. Our expert team ensures hassle-free registration, timely support, and personalized guidance to help you launch with confidence.

Expert Financial Guidance

Customized Solutions

Honest Communication

Dedicated Client Support

0

+

Successful Clients