Private Limited v/s LLP v/s OPC: Which One is Right for Your Startup?

Compare Private Limited, LLP & OPC structures to choose the best fit for your startup’s goals, compliance needs, and funding plans.

Startup India Registration

When starting a new business in India, choosing the right legal structure isn’t just a technical decision—it shapes your ability to raise funds, manage risk, and scale efficiently. According to the Ministry of Corporate Affairs (MCA), over 1.5 lakh companies are incorporated annually in India, and most of them fall into three categories: Private Limited Companies, LLPs (Limited Liability Partnerships), and OPCs (One Person Companies).

Each of these options comes with its own advantages, regulatory requirements, and suitability depending on your business goals.

In this detailed guide, we compare Private Limited, LLP, and OPC to help you make an informed decision for your startup. We also link to helpful resources if you want to go deeper into the registration or compliance process.

Why Choosing the Right Business Structure Matters

Your business structure determines:

– Your legal identity

– Personal liability exposure

– Tax obligations and deductions

– Your ability to raise capital

– Ongoing compliance and cost structure

If you’re just beginning your entrepreneurial journey, you can explore all our startup registration services in India for a broader look at other business structures, like sole proprietorship or partnership firm.

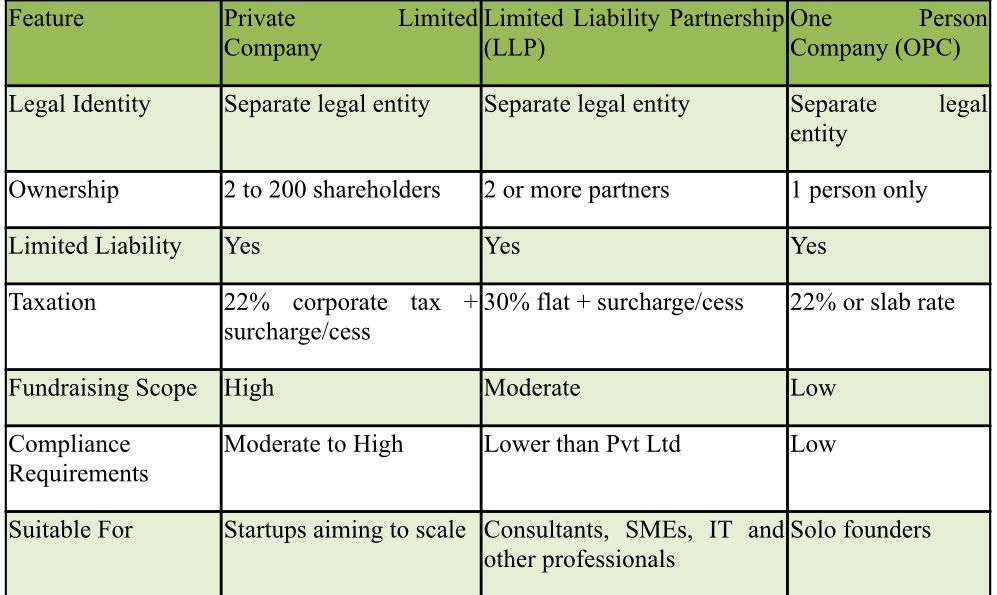

A Quick Overview of the Three Structures

Private Limited Company – Best for Scalability and Investment

The Private Limited Company is the most preferred legal structure among Indian startups and small businesses planning to scale. It offers a corporate identity, legal protection, and access to funding.

Key Benefits:

1. Limited liability protection for shareholders

2. Attractive to investors and VCs

3. Perpetual succession ensures business continuity

4. Separate PAN, bank account, and identity

Who Should Choose It:

– Tech startups and SaaS ventures

– Businesses planning for external investment

– Companies looking to build a corporate brand

Important Compliance Requirements:

– Annual filings with the Ministry of Corporate Affairs

– Appointment of auditor

– Mandatory audit by a Chartered Accountant

– Holding of board meetings and AGMs

Limited Liability Partnership (LLP) – Great for Professionals and SMEs

An LLP is ideal if you want the flexibility of a partnership with the benefits of limited liability. Governed by the LLP Act, 2008, it’s often chosen by consultants, professionals, and family businesses.

Key Benefits:

1. Lower compliance burden compared to companies

2. No dividend distribution tax

3. Suitable for equal decision-making among partners

Who Should Choose It:

– Consultants (legal, financial, technical)

– CA firms, advocates, doctors, engineers, architects and other service providers

– Small and medium enterprises (SMEs)

Taxation:

– LLPs are taxed at 30%, with no benefit of the reduced corporate tax rate available to companies.

One Person Company (OPC) – Tailored for Solo Entrepreneurs

Introduced under the Companies Act, 2013, an OPC gives solo entrepreneurs the benefits of a company without needing partners or co-founders. It’s especially useful in the early testing phase of a business idea.

Key Benefits:

1. Full control with limited liability

2. Suitable for freelancers and individual consultants

3. Recognized as a separate legal entity

Limitations:

– Cannot raise equity funding

– Optional conversion to a Private Limited Company after ₹2 crore turnover or ₹50 lakh paid-up capital

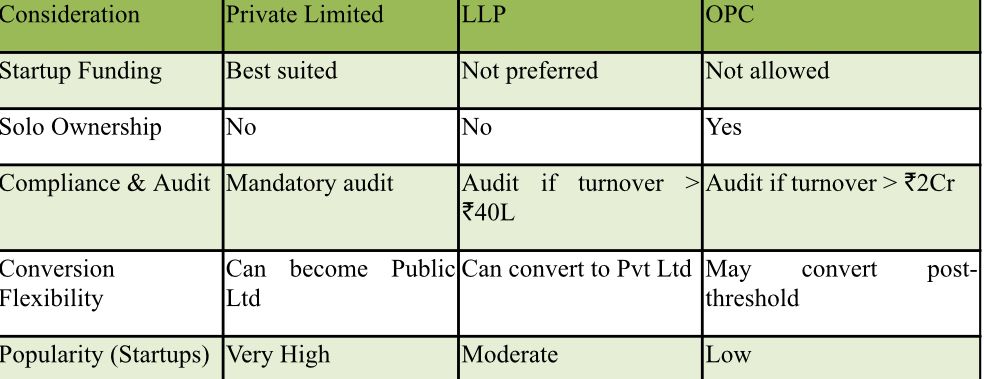

Comparison Snapshot – Choosing the Right One

How to Decide What’s Right for You?

Choosing the right entity depends on your short-term and long-term goals. Consider:

1. Number of Founders:

If you’re the only founder, an OPC may make sense initially. If you’re working with co-founders, consider LLP or Private Limited.

2. Funding Plans:

Planning to raise capital in the next 12–36 months? A Private Limited Company is your best bet.

3. Tax and Compliance Readiness:

LLPs offer simpler compliance and are cost-effective for smaller teams.

4. Industry and Customer Perception:

A Private Limited or LLP structure builds more credibility than a sole proprietorship or informal setup.

We Can Help You Get Started

At India Company Setup, we help new businesses navigate the entire incorporation process—from documentation and name approval to MCA registration, TAN application, and GST registration. Whether you’re planning to register a Private Limited Company, form an LLP, or start as an OPC, our team ensures that you’re compliant from day one.

We also assist with ongoing needs of the business like:

> GST registration and filing

> Accounting and bookkeeping

> RBI and other regulatory filings

> Trademark and patents filing

> Director changes, MOA amendments, and more

Let’s turn your idea into action. Contact us now for a free consultation and no-obligation quote.